Renters Foreclosure Rights

By frustrated

My family and I moved into a house in July. About 6 weeks after moving in, we began receiving mail from the homeowners association regarding overdue fees and a lein being placed on the property. After further investigation, we discovered that less than two weeks after signing the lease, the property was foreclosed on. We discovered this in October. I contacted the attorney for the bank and was told we have 90 days protection under the tenant protection foreclosure act of 2009. Again, I began researching and discovered that we should be able to continue residing here until the end of our lease. However, the bank has demanded that we vacate the premises within 3 days. Yes, that would be Christmas day. I spoke to our clerk of courts and was informed that no eviction has been filed. Is anyone familiar with the protection act and can you tell me what our rights are.

Edited on: Thursday, April 4th, 2013 10:18 am

5 Responses to “Renters Foreclosure Rights”

|

Bryan December 29th, 2009 3:21 am |

|||

|

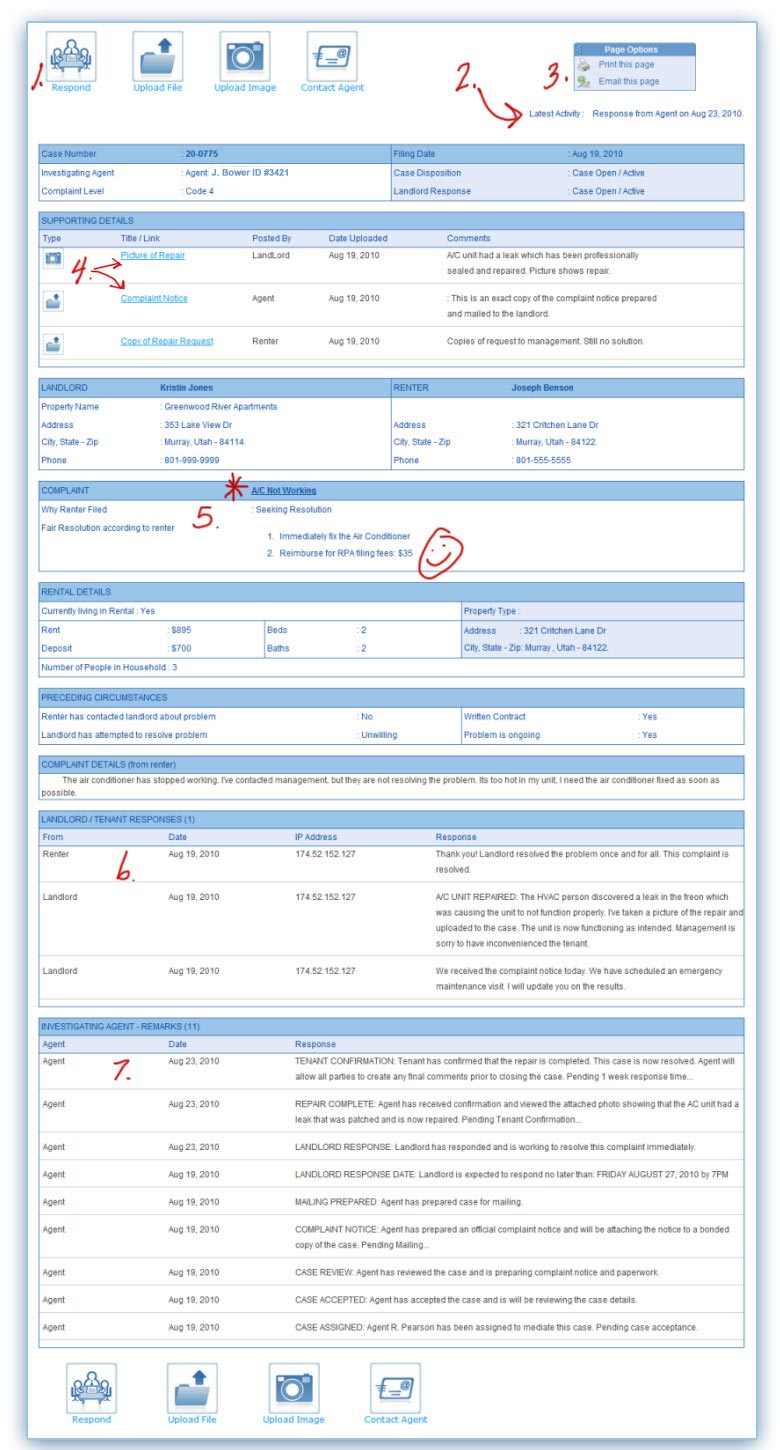

Hello Foreclosed Renter, Your situation is quite awful and sadly becoming more and more common. This is why it is so important to ONLY rent from verified property management companies or landlords. However, that is hind sight. (PS, if the they are RPA Verified Landlord you will usually see the RPA Approved icon on their ads, properties, lease agreements etc.) So now lets get down to the nuts and bolt of the new congress enacted renter protection against foreclosures. 1: The act is actually part of the “Helping Families Save Their Homes Act of 2009″ 2: TITLE VII – Protecting Tenants at Foreclosure Act 3: What protections are tenants given: 4: PROBLEM WITH THE “Quote” PROTECTION for tenants who’s landlords are foreclosed on: WHAT CAN A TENANT DO TO PROTECT THEM SELVES AGAINST LANDLORD FORECLOSURES? 1) ONLY rent from verified landlords. (highest approval in the industry is set by the RPA) 2) If the bank does not allow you to stay for the required amount of time, file a complaint with the RPA. I will post the actual act in a separate post. There is help! Don’t fall victim to the banks attempts to evict you. |

|||

|

Bryan December 29th, 2009 3:24 am |

|||

|

TITLE VII—PROTECTING TENANTS AT FORECLOSURE ACT SEC. 701. SHORT TITLE. SEC. 702. EFFECT OF FORECLOSURE ON PREEXISTING TENANCY. (1) the provision, by such successor in interest of a notice to vacate to any bona fide tenant at least 90 days before the effective date of such notice; and (2) the rights of any bona fide tenant, as of the date of such notice of foreclosure— (A) under any bona fide lease entered into before the notice of foreclosure to occupy the premises until the end of the remaining term of the lease, except that a successor in interest may terminate a lease effective on the date of sale of the unit to a purchaser who will occupy the unit as a primary residence, subject to the receipt by the tenant of the 90 day notice under paragraph (1); or (B) without a lease or with a lease terminable at will under State law, subject to the receipt by the tenant of the 90 day notice under subsection (1), except that nothing under this section shall affect the requirements for termination of any Federal- or State-subsidized tenancy or of any State or local law that provides longer time periods or other additional protections for tenants. (b) Bona Fide Lease Or Tenancy.—For purposes of this section, a lease or tenancy shall be considered bona fide only if— (1) the mortgagor or the child, spouse, or parent of the mortgagor under the contract is not the tenant; (2) the lease or tenancy was the result of an arms-length transaction; and (3) the lease or tenancy requires the receipt of rent that is not substantially less than fair market rent for the property or the unit’s rent is reduced or subsidized due to a Federal, State, or local subsidy. (c) Definition.—For purposes of this section, the term “federally-related mortgage loan” has the same meaning as in section 3 of the Real Estate Settlement Procedures Act of 1974 (12 U.S.C. 2602). SEC. 703. EFFECT OF FORECLOSURE ON SECTION 8 TENANCIES. (1) by inserting before the semicolon in subparagraph (C) the following: “and in the case of an owner who is an immediate successor in interest pursuant to foreclosure during the term of the lease vacating the property prior to sale shall not constitute other good cause, except that the owner may terminate the tenancy effective on the date of transfer of the unit to the owner if the owner— “(i) will occupy the unit as a primary residence; and “(ii) has provided the tenant a notice to vacate at least 90 days before the effective date of such notice.”; and (2) by inserting at the end of subparagraph (F) the following: “In the case of any foreclosure on any federally-related mortgage loan (as that term is defined in section 3 of the Real Estate Settlement Procedures Act of 1974 (12 U.S.C. 2602)) or on any residential real property in which a recipient of assistance under this subsection resides, the immediate successor in interest in such property pursuant to the foreclosure shall assume such interest subject to the lease between the prior owner and the tenant and to the housing assistance payments contract between the prior owner and the public housing agency for the occupied unit, except that this provision and the provisions related to foreclosure in subparagraph (C) shall not shall not affect any State or local law that provides longer time periods or other additional protections for tenants.”. SEC. 704. SUNSET. |

|||

|

Bryan December 29th, 2009 3:28 am |

|||

|

Here’s an article by Fosters Newspaper I found while doing research concerning this topic. The Director of the Rental Protection Agency was interview by the paper concerning a family that was foreclosed on. Here is the article: (posted at fosters.com) Somersworth tenants blindsided: Future uncertain after rental home is foreclosed upon By Jason Claffey EJ Hersom/Staff photographer From left, Michelle Reardon, John Reardon, Bea Lapointe, and Rick Lapointe stand for a photo at their rented Somersworth home that has been foreclosed upon. SOMERSWORTH — A family of five went to sleep Thursday night in fear of being forced out of their rented Pinecrest Drive home as early as today after it was auctioned off before the lease expired. Unsure what comes next, they spent recent days packing up their belongings. The story began last year, when Michelle and John Reardon signed a lease for the gray, ranch-style home, which they thought would keep them in one place from Oct. 1, 2008 to Oct. 1, 2009. They moved in with their 20-year-old son, as well as Michelle’s mother, Bea, and her husband, Rick. The five pulled together as a way to cut back on expenses after Rick suffered a stroke and was forced to cut back on his job as an upholsterer. Since then, the family said they have dutifully paid their $1,450 monthly rent, hoping to one day buy the home — something they said they discussed with their landlord. But in June, after Michelle saw a man pull into the driveway unannounced and started taking pictures, their landlord left a message saying their home was going on the auction block. “We had no notice,” Michelle said from the home Tuesday. That could be a violation of law, one official says. In May, Congress enacted the Helping Families Save Their Homes Act, which established protections for tenants living in foreclosed homes. The legislation requires tenants receive a 90-day notice of eviction, according to Scott Paxton, director of the Rental Protection Agency, which bills itself as the national authority when it comes to enforcing rental laws. “Unfortunately they’re still going to be evicted, but hopefully it will buy them a little more time to find another place before being put out on the street,” he said of the law. Michelle said her family began receiving mail in early June from a Massachusetts law firm handling the foreclosure, and that two lawyers they have consulted confirmed they were entitled to the 90-day notice. Reached by his cell phone Tuesday night and asked about the issue, landlord John DeMaria said, “Not interested,” and hung up the phone. Michelle said the landlord has been difficult to get in contact with since he left the message about the auction. Three weeks ago, Michelle said, two Realtors representing a bank showed up at the door and said the family needs to leave by July 31 and that the bank would offer them a “few thousand” dollars to leave by today. “Why would a bank that owns a property offer somebody money to move out? That’s ludicrous,” Michelle said. “We’re not going anywhere.” County deed records registered this week confirm that GMAC Financial Services purchased the property after a scheduled July 1 auction. Jeannine Bruin, a GMAC spokeswoman, said the company could not negotiate with the tenants until it had possession of the property. Now that that’s happened, she said, “if the tenant wants to make a reasonable offer we’re open to that.” She maintained the company complies with the law’s 90-day notification requirement and said GMAC has not notified the tenants that they need to vacate the property. The family hasn’t paid their July rent — as they are unsure if they will get their $1,450 security deposit back — and are worried they will be forced to leave. “We don’t know what we’re going to do,” Michelle said. “We’re just living here day to day, waiting for the next bomb to drop.” Paxton, whose Utah-headquartered agency assigns agents to mediate disputes, said deposits are typically not refunded because “the landlord doesn’t have the money to refund it. That’s the number one complaint we deal with.” The family said it doesn’t want to pay legal fees in case they have to pay for a new apartment. Money is tight, they say. Michelle and her mother, Bea, work for Homemakers Health Services in Rochester, while Michelle’s husband works in construction. Bea recently contacted Foster’s about their situation as a last-ditch effort. “We didn’t ask to be put in this position,” she said. They’re not alone, Paxton said. “It’s a very growing problem,” he said, “and unfortunately I don’t think it’s going away.” |

|||

|

Fellow renter December 12th, 2011 3:32 pm |

|||

|

Bryan, what can you tell us about the pre-foreclosure stage? Once a tenant receives a copy of the notice of default or a lis pendens, should he/she continue to pay rent to landlord or stop paying? I heard that lenders don’t like for borrowers to collect rent while they are not paying their mortgage. What does the law say about this? Should they be afraid of being evicted, should they wait for sale date and then wait for the 90 day notice? What are the rights and obligations in this case? Thanking you in advance, |

|||

|

Arizona Rentals July 12th, 2013 4:23 am |

|||

|

This is basically good site.Thanks for this this post. The Group Phoenix Real Estate, Scottsdale Real Estate, Paradise Valley Real Estate, Arizona Rentals, Phoenix Rentals, Scottsdale Rentals, Paradise Valley Rentals, Arizona Rentals. Phoenix Real Estate, Scottsdale Real Estate, Paradise Valley Real Estate, Arizona Rentals, Phoenix Rentals, Scottsdale Rentals, Paradise Valley Rentals Management. The Group Phoenix Real Estate, Scottsdale Real Estate, Paradise Valley Real Estate, Arizona Rentals, Phoenix Rentals, Scottsdale Rentals, Paradise Valley Rentals. |

|||

Close

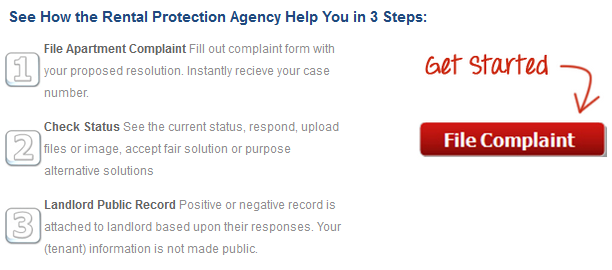

Yes, the RPA® Can Help You!

Filing an official complaint is the nation's fastest way to solve tenant problems.

Not Ready? Learn more...

Need Help Filing Your Complaint?

Agents Available Mon- Fri 10am to 10pm

Recently Resolved Complaints:

See how the Nation's Rental Authority has helped thousands of tenants already!

-

Repairs, Eviction Of No P...

ODENVILLE, AL - 35120 5328

Case Number 24-3252

-

Water Damage...

Las Vegas, Nevada - 89106

Case Number 23-8699

-

Air Conditioning Has Not ...

Atlanta , Georgia - 30318

Case Number 24-3257

-

Withholding Deposit...

Dallas, Texas - 75287

Case Number 23-8821

-

rodent infestation, extre...

Brooklyn, New York - 11221

Case Number 23-0712

Ask Question:

Post a new question to the RPA Tenants rights forum.

You Have Tenant Rights.

Recently Posted Questions:

Over 4,000 questions have been asked by tenants including these new posts:

Tenant Rights Categories

Popular categories about renters rights.

-

- Apartment Complaint (618)

- Frustrated Landlord (21)

- Frustrated Renter (949)

- General Topics (556)

- Landlord humor (2)

- Landlord Legal (25)

- Landlord Problems (846)

- Landlord Q & A (14)

- Landlord Stories (5)

- Landlord Tips (7)

- Legal Questions (1105)

- Rent Horror Stories (192)

- Rent Humor (12)

- Renter Q & A (449)

- Tenant Problems (34)

- Videos Post (109)